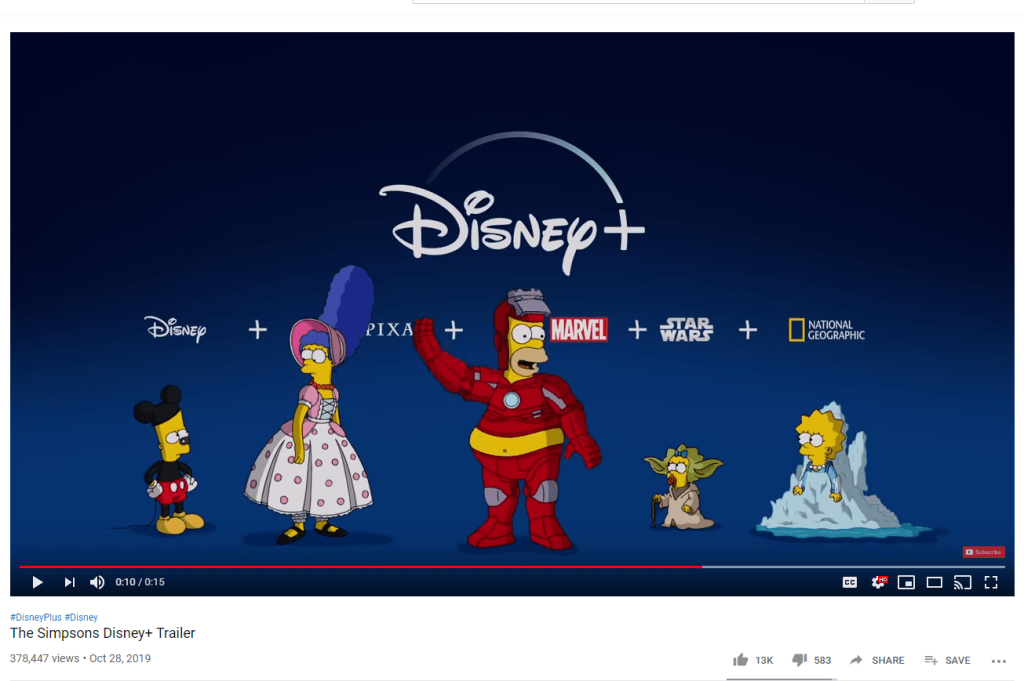

On November 12th, Disney officially rolled out its streaming service. As the roll out approached, ads like the image below, taken from Youtube, really shows the full breadth of what Disney has to offer.

As a new member of Disney +, here is a look at the log in screen. According to disneyplus.com, you sign up for Disney + for $6.99 or a package that includes Hulu, Disney + and ESPN.

Netflix, on the other hand, is offering a free 30-day trial period. Considering that Disney is $2 cheaper to Netflix’s basic account, there is still a huge discrepancy in content.

So, does this mean it’s time to buy Disney? Although Disney has been increasing its debt ahead of the Disney + launch, it’s still reasonable to its current value. As of the last quarter, Disney had a total of $91.13B in both short-term and long-term liabilities. Deducting short term assets of $23.53Billion, the mouse house has a total liability of $67.6Billion. Its value, which is generally determined by multiplying the stock price by outstanding shares, is currently at $254.8 Billion. This is a good sign since it should not have any problem raising capital if the need arises.

Lastly, Disney pays its investors a regular dividend semi-annually. Currently the dividend is $.88 cents per share. Which generally speaking is a good sign of a company’s financial health.

In my opinion, Disney is a solid buy with a lot of potential from its multiple revenue streams, especially Disney +, where they have a considerable library of content over their competitors. Some analysts suggest waiting out the excitement over the new streaming service. This is a sound argument, but I would not wait too long. Disney seems poised to take over the streaming space and have a very strong Q4.