Delta Air Lines (DAL) – The usually strong stock traded lower than expected this week. The company announced it was adjusting their expectations for the Q3 results due to be reported on Oct 10th. The airline explained that higher than anticipated nonfuel costs increased approximately 7th year over year. This was particularly interesting considering that both domestic and international travel increased 8%. Many analysts still think this company is valued right and recommend a buy. I however think that if the economy is on shaky ground, fewer people might want to fly.

Levi Strauss & Co (LEVI) – The clothing maker is set to announce earnings on Oct 8th. In it’s second quarterly earnings results, much is expected. Back in July, the cost of the IPO and changes in foreign currency caused an earnings miss, sending share prices below the IPO price. On the upside, Yahoo Finance reports that Levi “is teaming up with Google to make another smart jacket…(that) will connect to your smartphone using Bluetooth. It will be able to tell you the time, weather, traffic, and alerts you if your forgot your phone.” This is great news for people like me who are crazy Back to the Future fans. All we need is Nike to get those auto lace shoes more affordable and we are in.

Preview of week 10/14

Next week a lot of earnings are being announced. Here is a few of the more interesting ones.

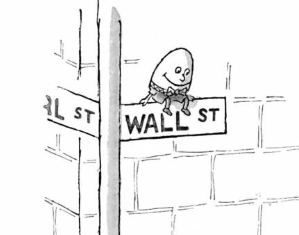

The financial sector will be jump into action with Goldman Sacs (GS), JP Morgan (JPM), Morgan Stanley (MS) and many others announcing earning. We will be interesting to see how the Fed cutting rates have impacted business.

Netflix (NFLX) – Good news, they are making another Stranger Things! Bad news, it will be last one (also the whole thing with Disney, Amazon, Apple taking a bite out of Netflix’s customer base). Earnings will be announced on 10/16

UnitedHealth Group (UNH) – Despite the tough shape the health care sector has been in, UNH has delivered very strong results over the years. However, in 2019 and with political discourse stirring things up, share prices have not reflected the stronger financials of the company. Will be interesting to see how investors will react if there is an earnings beat. Earnings announced on 10/15