Last week, Slack Technologies Inc. (WORK) decided to go public. If you are not familiar with Slack, here is how Bloomberg describes the company. “Slack Technologies, Inc. operates as a software company. The Company designs and develops communication platforms that provide real-time messaging, file sharing, archiving, and searching services for teams. Slack Technologies serves clients worldwide.” Slack has some ardent supporters, but also has competition from some of the biggest names in the business, such as Microsoft, Google, Cisco and Jabber (which my workplace uses). Now, I would normally analyze the company, the financials and the industry, but feel there are a couple of interesting points that need to be made about this company and why I feel this is not a good company to invest in.

First, most companies go public in order to raise capital. An IPO is usually issued which allows the public the opportunity to buy new shares. In rare cases, when some more established companies go public, they do what is called a direct listing. This essentially means that only shares that are being sold are from current shareholders, no new shares are issued. So, this must mean that Slack has a strong balance sheet and doesn’t need capital infusion from new investor’s right? Not even close.

All you have to do is pull open the S-1 form that is listed on Sec.gov (don’t worry, I got you covered (https://www.sec.gov/Archives/edgar/data/1764925/000162828019004786/slacks-1.htm ) and you will see what all the hype is about. The company is hemorrhaging money. For a company that did not want capital from investors, someone should take another look at the books. In 2018 alone, Slack lost an astounding $139 million. In just the first half of 2019, Slack racked up losses $31.8 million, approximately 24 % of total revenue. Despite having almost doubling revenue from 2018 to 2019 (220.5M vs 400.5M, respectively), the company seems to be just dumping more and more money into their operating budget. In 2017, total operating expense was $238M, in 2019 it almost doubled to $500M.

Finally, it’s a small fish in a big pond. Slack has a loyal following, but even in the company S-1 filing, they realize their short comings: “Some of our larger competitors have substantially broader product offerings and leverage their relationships based on other products or incorporate functionality into existing products to gain business in a manner that discourages users from purchasing Slack, including through selling at zero or negative margins, product bundling, or closed technology platforms.”

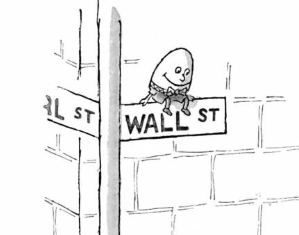

There are more reasons to stay away from this company, but these are the biggest factors. Despite the company’s effort to jump into the big leagues, they have may have missed the mark. With so many strikes against them, it seems they may have just turned the company name into a verb.

Work Cited

https://www.bloomberg.com/profile/company/1089727D:US

https://www.workzone.com/blog/slack-alternatives/

https://www.sec.gov/Archives/edgar/data/1764925/000162828019004786/slacks-1.htm